Identifying and understanding the resources available to support family members with disabilities takes time, but is essential. This is particularly important in the area of finances. A brief outline of some programs that are available to individuals with disabilities are outlined below.

Social Security provides assistance to people with disabilities through Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI). Social Security also offers youth friendly resources to connect youth and young adults with disabilities to important information to achieve education, career, and life goals.

Below are the basic differences between SSI and SSDI.

Supplemental Security Income (SSI) provides monthly financial support to individuals 18+ with a qualifying disability and limited financial resources. Children under 18 may qualify if they live at home and the parents’ financial resources are limited. In general, individual assets should be below $2,000. A helpful brochure, “What You Need To Know About Your Supplemental Security Income (SSI) When You Turn 18” is available here. Always consult with the Social Security Administration directly to discuss your specific circumstances and if you meet the income/asset guidelines for this program.

For more information on how SSI works, who is eligible and how to apply, visit their website.

Social Security Disability Insurance (SSDI) pays monthly benefits to individuals with a medical impairment (physical or mental) that keeps them from working AND who have paid enough into Social Security taxes through working in the past. An adult child (age 18+) may qualify for benefits on a parent’s earnings record, if the child has a disability that started before age 22. The amount of SSDI depends on the wages of the worker and is not based on income/assets.

For more information on disability benefits, visit their website

You can apply for all Social Security disability benefits online, by phone, or in person.

Understanding Income and Limits

Understanding Benefits and Work

What is the Student Earned Income Exclusion?

CONTACT INFORMATION:

Federal Building, Suite 101

401 West North Street

Lima, OH 45801

Phone 800-223-0288

or

277 S. Looney Road

Piqua, OH 45356

Phone 866-931-2520

Medicaid is a federal health care program for people with low incomes and limited resources, including people with disabilities. If you receive SSI benefits, you may also receive Medicaid.

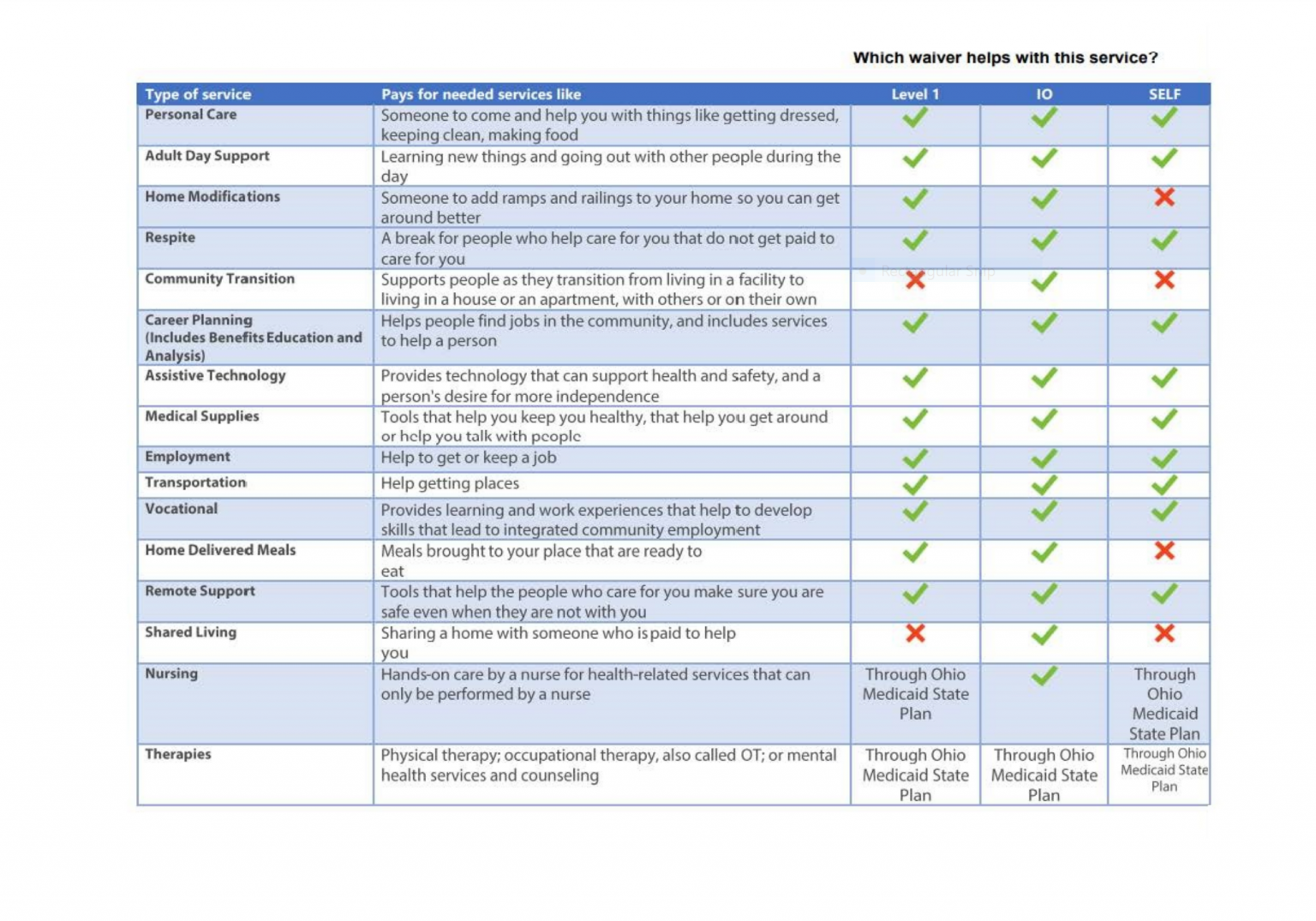

There are three Medicaid waivers that are administered by the Ohio Department of Developmental Disabilities. These waivers are one way to pay for services to support someone with disabilities living on their own, with family, or with a roommate.

To determine waiver eligibility, Mercer DD assesses each person to understand their unique needs for services now and in the future.

The Level One Waiver is a good fit for people who do not need many paid support staff to provide services

The Individual Options (IO) Waiver is a good fit for people who may need a lot of help in their home, or for people who need different kinds of services.

The SELF Waiver is a good fit for people who want to be in charge of some of their services.

Special needs planning is estate and financial planning for the future when an individual with a disability is involved. Planning helps families ensure their loved ones are cared for when they are gone. It also makes sure that loved ones remain eligible for benefits. Special needs planning can be complex and confusing. The Ohio Developmental Disabilities Council provides a booklet that may be helpful: Planning for Bright Tomorrows: Estate and Future Planning for Ohioans with Disabilities and Their Loved Ones

A Special Needs Trust is one tool that can hold assets for a person with a disability. When assets are in a Special Needs Trust, they do not affect eligibility for Social Security or Medicaid. Therefore, a person with a disability can have more assets than the public benefits programs usually allow, approximately $2,000. There are many different types of Special Needs Trusts. To determine which one may be right for your family, consult a financial planner who specializes in this type of planning.

A STABLE Account is an investment account available to eligible individuals with disabilities. STABLE Accounts allow individuals with disabilities to save and invest money without losing eligibility for certain public benefits programs, like Medicaid, SSI, or SSDI. Earnings are not subject to federal tax if spent on “qualified disability expenses”.

FAQs For STABLE Account

Mercer County Quest

Discovering Your Path To Adulthood

567-890-1202

Menu